top of page

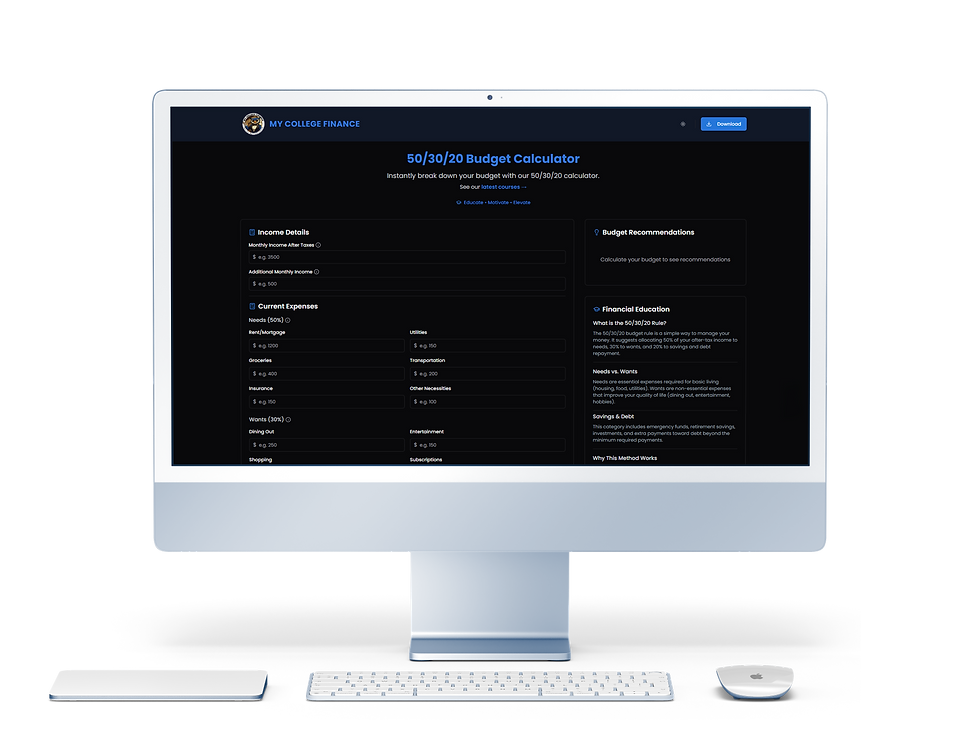

Stop second-guessing your spending. Our intelligent 50/30/20 calculator instantly organizes your income into a simple plan: 50% for essentials, 30% for fun, and 20% for savings and debt payoff. No spreadsheets, no stress—just clear guidance you can trust. In seconds, you’ll know exactly where your money should go so you can focus on living, not calculating.

1. Smart Budget Automation

Numbers don’t have to feel overwhelming. With interactive charts and progress trackers, you’ll see exactly where your money is going—what’s working, and where you can save more. Our engaging visuals turn budgeting into something you want to check in on—like leveling up in a game where the prize is your financial freedom.

2. Clear, Visual Financial Insights

Show off your financial responsibility with confidence. Generate polished PDF budget reports you can easily share with parents, financial advisors, or even loan officers. Whether you’re proving independence or seeking support, you’ll have bank-quality documentation ready at your fingertips—professional, organized, and stress-free.

3. Professional-Grade Reports

Budgeting doesn’t have to be a solo journey. Share your wins on social media, celebrate milestones with friends, and connect with others working toward the same goals. By turning money management into a community experience, you’ll stay motivated, supported, and inspired to keep making progress.

4. Motivation Through Community

bottom of page